One of the hardest things to predict when moving into our car was how much money we would spend. Most of the informative articles we found were about van life costs, but we wouldn’t be living in a van – we would be living in a car. So we’re going to write the detailed article we wish we had when we started. We’ll answer some common questions about how much it costs to live in your car, review our budget, and provide some tips to help you save money.

Can I use the car I already have?

You can, but consider how much room you need to be comfortable. SUVs are more popular to convert than normal cars for a reason. We chose to purchase a used Prius V after our normal Prius broke down. The Prius V has a surprisingly large interior and we are both able to fit comfortably. Another car we considered was a Toyota RAV4, but the Prius V had better gas mileage. If you choose to live in a normal sized car, it would likely be beneficial to remove the front passenger seat. Check out this build in a Camry by Reddit user u/camrycamper.

How much does it cost to convert a car?

It depends. It can be done very cheaply, depending on your needs. Car converts seem to be much cheaper than converting vans, which can cost $1000s. We spent probably less than $100 to build our bed platform. We removed the back seats and used wood beams as the frame, metal brackets to attach it to the car, plywood for the platform, and cheap carpet to top it off. Our mattress is a 4” memory foam topper we already had and cut to size. You can probably do it even cheaper than us if you just fold down the back seats and put a mattress right on top. The downside here is less storage space.

Check out this detailed article on how we built our bed platform.

Another expense to consider is the gear that you’ll need to live in your car. Again, this expense can vary widely depending on your needs. We invested in a portable power station and a powered mini fridge. You definitely don’t need these items though. A normal cooler with ice can keep food cold for days. Public places like malls and libraries are readily available for charging electronics. We pay $46 per month for two memberships with Planet Fitness, so we can shower every day. If you’re planning on going off-grid, you can invest in a portable camping shower. In this article, we outline all the items we keep in the car with us.

How much do you spend every month living in your car?

On average, we’re spending around $1600-$1700 per month for two people in the U.S.. We eat out frequently and drive a lot, which drives up our expenses. We mostly sleep in free areas and don’t typically pay for entertainment. This also includes our $100/month storage unit. We have unlimited data cell phone plans with Verizon since we both work remotely.

What are the largest expenses for living in your car?

Our four largest expenses are:

Groceries – 21% of our budget

Auto Repair/Maintenance – 23%

We had a major repair down when the emergency brakes seized our first month of travel, which drove up this expense. This category also includes car insurance.

Gas – 16% of our budget

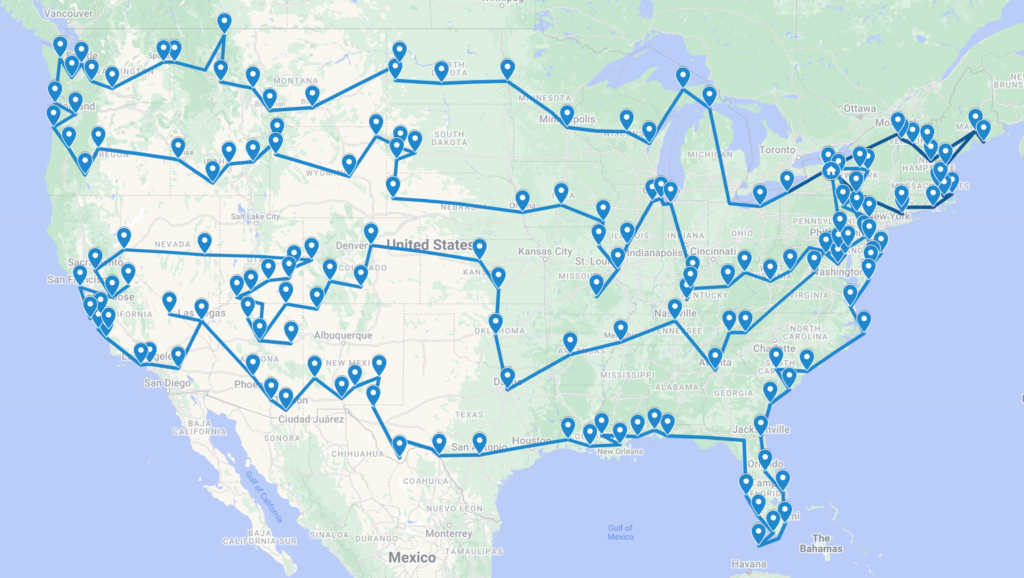

We travel a lot. Our goal is to visit the lower 48 states in a year, so we do a lot of driving. In our first four months, we drove over 13,000 miles. We usually spend about $300-$400 per month on gas.

Restaurant/Cafe – 15% of our budget

We also like to eat out a lot and try local restaurants. We typically spend $200-$300 per month on sit down restaurants, not including fast food.

Check out the chart below for a full breakdown of our total expenses for the first four months of living in our car.

The table below breaks down in detail our expenses per month while traveling and living in our car.

*The $1386.43 auto repair expense in May was excluded from average calculations since it was an unusual and one-time expense. Including this expense would not reflect our typical living costs.

**There was no phone bill for May-July because we took advantage of a promotion from Verizon to get a $500 gift card to apply to the bill.

Note:

Health insurance and health expenses were excluded from this analysis as these can be vastly different for each person.

Some expenses paid for with cash (like some coin laundry facilities) were also excluded from this analysis. Including these expenses would have a very small impact on this analysis.

Can you save money living in your car?

Probably. Overall, we’re saving about $500/month living in the Prius compared to living in our western NY apartment. We both switched to working part time instead of full time, which allows us to travel more. See the table below for a detailed comparison of our expenses.

*The $1386.43 repair expense was excluded from average calculations since it was an unusual and one-time expense. Including this expense would not reflect accurate living costs.

Tips to Save Money While on the Road

Find free places to stay

There are plenty of free places to park your car for the night. Take advantage of free campsites. If you’re out west, you can often camp for free on BLM Land (public land managed by the Bureau of Land Management). You can park overnight in certain rest areas, depending on the state. A few businesses like Walmart and Cracker Barrel allow you to park overnight in their parking lot (make sure that your location allows it first). We like to use the app iOverlander to find a place to sleep.

Cook your own food

Eating out at restaurants can definitely add up. You can minimize expenses by cooking your own meals. We have a two-burner propane stove we use to cook.

Here is a list of our favorite meals to make while on the road.

Plan out your route in advance

Planning out where you’re going ahead of time, can help you plan out the most efficient route, saving you time and gas. We also like to use Google Maps to find the cheapest gas stations.

Get a national park pass

The $80 America the Beautiful Interagency Pass is well worth the money. It’s more than paid for itself for us. This pass allows you access to national parks, national forests, and much more. We highly recommend it.

Get a good rewards credit card to earn cash back

We got the AMEX Blue Cash Preferred® Card right before we started living in our car. We get 6% cash back on groceries, 3% back on gas and transit, and 1% back on everything else. The 3% cash back on gas is the highest we’ve seen for rewards credit cards. After you spend $3000 in the first six months, you get $350 cash back. The credit card is free for the first year, then it’s $95 annually. If this card isn’t for you, there are plenty of others out there.

Analyze your expenses

Keep track of how much money you spend. It’s easy to get carried away if you don’t sit down every so often and check your bank account.

Look for free entertainment options instead of paid

We tend to avoid most paid attractions. We do a lot of hiking instead, which is usually free.

Choose a phone plan that’s right for you. Take advantage of promotions offered by cell service providers.

Take a look at what kind of plan you actually need. If you don’t need unlimited data, consider moving to a cheaper plan. In addition, cell service providers often run promotions for switching to them. I was on AT&T for a long time. When I switched to Verizon with an unlimited plan, we got a free $500 gift card that we applied to our bill for a couple months.

Maintain your vehicle

Get your car inspected regularly, along with routine oil changes. This can help prevent expensive repairs later on.

Spend time in public areas

If the weather is really hot, we like to go to malls or libraries instead of running our air conditioner all the time. Public parks are also a great place to hang out. It’s nice that there is no expectation that we spend money.

Get an E-ZPass if applicable to save on toll roads

If you’re planning on sticking around the northeast of the U.S., getting an E-ZPass will give you a small discounts on toll roads.

Consider getting AAA

When our emergency brake seized, AAA saved us a lot of money getting our car towed to the repair shop. It helps our peace of mind knowing that if we break down, we won’t be stuck with a large towing bill.

We hope you found this article helpful. If you have any other questions, feel free to post them in the comments section below.

Enjoy this article? Please consider sharing it to social media.

Note: This page contains Amazon affiliate links. Please consider supporting our blog by purchasing through these links. We will receive a small commission at no extra cost to you.